LOYALTY MARKETING

SECTION ONE

SECTION TWO

Are Independent Grocers Losing the

Retail Arms Race?

The growth in shopper marketing budgets comes as manu-

facturers are simultaneously reducing spending on traditional

trade promotion. A 2012 trade promotion study by Kantar Retail

shows manufacturer spending on trade promotion, measured

as a percentage of gross sales, at the lowest level since 1999.

But even this does not tell the whole story; it is the changing mix of manufacturer marketing expenditures that shows what is occurring. Trade promotion accounted for 44% of total marketing expenditures by manufacturers in 2011, lower than any other year in the past decade. This decrease is driven by a corresponding increase in Shopper Marketing expenditures.

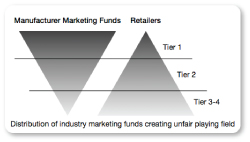

Here is the most worrisome part of this trend: a disproportionate share of these vast marketing funds is directed to the largest retailers. Those are the retailers possessing powerful shopper insights and the technology and willingness to direct specific promotions at specific shoppers to drive business in collaboration with the key brands.

This story is just beginning. The Kantar Retail report goes on to say “manufacturers anticipate that changes in the next three years will revolve around continued trade integration with Shopper Marketing to maximize value in the face of continued margin demands. Manufacturers, in particular, expect to allocate trade funds more strategically in the future, as they shift to a ‘pay for performance’ approach and more closely measure program and retailer performance.”

Shopper insights are driving increasing marketing personalization; that is, those personalized promotions funded by incremental Shopper Marketing funds paid for by the large brand manufacturers.

Personalized marketing is the advanced weaponry of today’s retail battle; it is retail’s version of laser-guided smart bombs. From Kroger’s mailing of highly relevant promotions to its shoppers to Safeway’s Just for U program delivering savings on relevant products to its loyalty program members, this battle is well underway. Ahold is pursuing a similar strategy; CVS holds the leading position in the drug store channel, delivering personalized, relevant promotions to members of its ExtraCare program. Personalized marketing has proven its ability drive increased basket size, increased shopping trips, and increased shopper retention over time. And if you’re a top-tier retailer, you get all these benefits paid for by manufacturers funding those personalized promotions to your shoppers.

This personalization, being done on a massive scale, is far beyond what many retailers envision; these initiatives are being driven by high-powered analysts (dunnhumby has an estimated 200 analysts focused on Kroger alone!) and, increasingly, next-generation web-based personalization engines are being put to the task. The most advanced of these technologies are able to watch in real time what shoppers are looking at or searching for when online via their PC or mobile, and able to serve up relevant promotions, content, cooking videos, recipes, and more. Another solution provider works with Tier 1 retailers using their loyalty data to link via cookies to the same shopper online and be able to present web advertising based on purchases in the physical store. The future of retail is about delivering the right promotion to the right shopper at the right time and in the right place.

Retailers continuing to go to market with “no loyalty card required” or “same prices for everyone” are destined to become a quaint anachronism as shoppers of all ages increasingly expect to be catered to through savings on products and services relevant to them.

The cumulative force of these trends is laying siege to a wide swath of the supermarket sector. Independent and mid-market retailers are increasingly unable to keep pace because they lack in-store best practices, sophisticated technologies, and powerful shopper insights. The growth of Shopper Marketing budgets and the distribution of a disproportionate share of those funds to the largest retailers are slamming independent / mid-market retailers from both sides. There is little ability to access these incremental promotion funds to drive shopper spending while reduction in historical trade promotion decreases competitiveness.

Wholesalers, who many independent and mid-market retailers rely on to procure manufacturer deals, are able to offer little help. Wholesalers have no shopper data and do not possess the sophisticated tools and analysts required to power shopper insights used to gain access to new manufacturer marketing funds, let alone any digital channels to the shopper. The problem made worse by the fact that wholesalers - already challenged by retailer compliance with regard to regular trade promotion - lack the scale requisite to fight this new battle.

This growing retail industry schism between the very largest retailers and everyone else is only going to get worse. The same Kantar Retail report strongly calls out that the future success model will involve deeper and more extensive collaboration between the retailer and brand, with focus on clear objectives and performance accountability. This is much easier for the brands to accomplish when deploying entire teams of people against a Kroger or Target or Walmart; it is much harder - some could say impossible - when having to interact with hundreds or thousands of mid-market and independent retailers.

These companies are very much at risk of losing their most important historical advantage - connecting with the customer - when the largest retailers have more knowledge of that shopper’s preferences and caters to her.

Admittedly, this is a rather bleak view of the future for independent and mid-market retailers. Is all lost? Not necessarily, but time is running short. Before one can rectify a problem, one has to first acknowledge that there is a problem.

This essay was written by Gary Hawkins, CEO of Hawkins Strategic, a consultancy focused on

gathering, understanding and using detailed customer data in retail. It was excerpted from the book, “The Essentials of Shopper Technology.” For more information: www.hawkinsstrategic.com.

Click on the LinkedIn logo to join the new Shopper Technology Institute Discussion Group

SECTION THREE